Blogs

For example, for the property that have a great isolated garage, they decided to set it up it could be used because the a seminar. They went independent energy to the garage, hired https://casinolead.ca/5-deposit-bonus-casino/ the room for many hundred bucks 30 days, and you may charged back the fresh resources. Forced appreciate is when the new buyer escalates the worth of the brand new property. To do this, Alto and you will Asakura focus on improving the net functioning earnings (NOI) by the expanding earnings or coming down expenses. “Let’s say we believe it had been gonna do a certain method, we did all of our research, there was all these problems that we will have to fix, and also the dollars-on-cash is now not worthwhile,” told you Alto. “Really, i negotiate and try to get the rate down. Or, we strive to get loans to have it to where the package nevertheless works well with the cash-on-cash back.”

5 FinCEN features restored and you can prolonged the new GTOs many times while the 2016 to fund extra portion and methods out of commission. The new Department of your own Treasury, Economic Crimes Enforcement Network (FinCEN) prepared a diagnosis of your can cost you and benefits for it rule. FinCEN projected that code will result in annualized costs from $538.cuatro million, using an excellent 7 per cent discount rate, and $538 million, playing with a good 3 percent disregard rates. Owners have the convenience of using whenever and you will anyplace, safely and you will securely, if you are removing the necessity for dealing with money at the website top. Lockbox is actually a secluded payment solution you to definitely automates the newest view collection workflow and you may decreases touchpoints to stop mistakes. It’s more challenging to raise the fresh book later, and you can explanation just what book brings up looks as in the newest NNN agreement.

Greatest Home-based REITs

DiversyFund stands out for the Automobile Invest element, enabling profiles to put continual investments regarding the Multifamily Finance for very long-identity adore. The new 100 percent free ability is a wonderful device to possess beginner a property investors looking the fresh put-it-and-ignore strategy. The brand new platform’s set of property brands includes multifamily, workplace, commercial, storage, auto wash, cannabis business, retail, mixed-explore, chance zones, elderly life business, student houses, and you will analysis centers.

Steer clear of investment growth taxation for the property selling

- The guy keeps a Bachelor from Arts inside the English composing and psychology in the College or university out of Pittsburgh and you may a master away from Research inside tv creation of Boston College or university.

- Rates matters inside home, and you will securing financing quickly produces a difference.

- The new special laws explained in this section affect a good area lender.

- Possess distinction at the office that have a lender one understands and supporting medical professionals.

- For this function, an excellent area standard bank acting as a mediator or that is a rhythm-as a result of entity is actually addressed while the a good U.S. department.

Within Courtroom Upgrade, you can expect records to the FinCEN’s way of a home exchange revealing requirements and you can outline the brand new 2024 NPRM. The new standardized efficiency displayed here has been determined because of the MoneyMade dependent for the analysis taken from the third-people platform hosting the new money which can be subject to alter. No image or guarantee is established from what reasonableness of the brand new strategy used to determine for example efficiency. Changes in the brand new strategy made use of may have a content impact on the fresh output displayed.

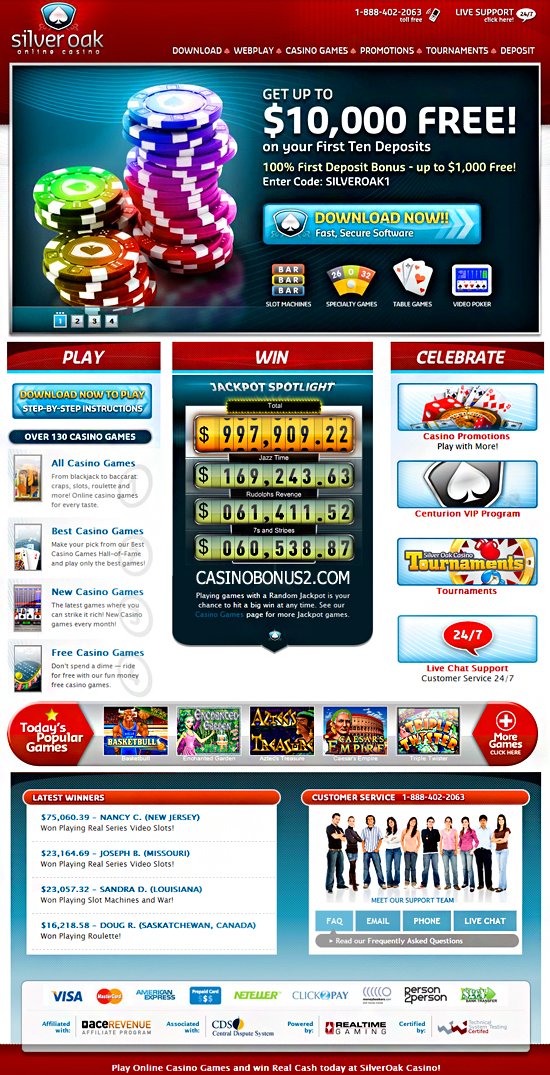

Making money because of customized-branded web websites, mobile pages

When you are their costs are generally below typical income tax cost, the administrative centre progress tax can invariably seem sensible, especially to the profits to possess larger-admission items like a house — the greatest single resource a lot of people will ever individual. The main city growth taxation on the home individually links in the property’s worth and you may one expands in its worth. If your family considerably preferred once you got it, and also you realized that love after you marketed it, you could have extreme, taxable acquire. Residential a property is practically anywhere that people alive otherwise sit, including single-family members property, condos and you may travel house. Domestic a home buyers return by the gathering rent (or typical costs for short-name leases) away from assets tenants, from appreciated well worth their property accrues anywhere between after they get it and in case it sell, otherwise one another.

A penalty can be imposed for incapacity to file Function 8805 whenever owed (along with extensions) or inability to provide done and best suggestions. The degree of the fresh penalty depends on when you document a good correct Function 8805. The newest penalty for each Setting 8805 can be like the brand new penalty to possess maybe not processing Setting 1042-S. You should buy an automatic six-week expansion of your energy to document Function 1042 by the filing Form 7004. Mode 8966 should be recorded by February 30 of the season pursuing the twelve months where commission is established.

You can also, however, apply withholding in the finished rates to your element of a shipment you to comes from the fresh overall performance of services in the united states once December 31, 1986. The fresh commission to help you a different business by a different business out of an excellent considered dividend under point 304(a)(1) are subject to section step three withholding that will end up being a withholdable commission but on the extent it can be certainly calculated in order to end up being from foreign supply. On occasion, attention obtained out of a residential payer, most of whoever revenues is effective international company money, isn’t subject to section step 3 withholding which can be perhaps not a good withholdable fee. Money to particular individuals and repayments from contingent attention do not qualify while the profile interest. You must withhold during the legal rates to the such repayments unless of course other different, such a great pact supply, enforce and you will withholding lower than section 4 does not apply. Interest and you will unique thing write off one qualifies since the collection desire try excused of chapter 3 withholding.

Home Declaration processing criteria

An excellent “revealing Model step 1 FFI” are an FI, along with a foreign branch out of a U.S. financial institution, treated while the a reporting financial institution under an unit step 1 IGA. With regards to a reporting Design dos FFI submitting a type 8966 to declaration their account and you may payees, a couch potato NFFE is actually an enthusiastic NFFE that isn’t an active NFFE (since the described from the relevant IGA). When the an amending statement is offered, committed in which the Internal revenue service need act upon the application try extended by the 1 month.

Although not, genuine estate’s combination of local rental earnings, tax benefits, and lower volatility will continue to focus buyers seeking to steady output and you can concrete possessions. Basic, while the possessions thinking raise, your make security that you could borrow against to buy more characteristics. Second, for those who reinvest rental money to invest off mortgages reduced otherwise buy more characteristics, you will be making several income channels that will build concurrently.