Blogs

Hard-rock Wager also offers greeting incentives for new users, in addition to many campaigns to have present people to help you pick from. The newest desk below provides a complete report on the best Fl bonuses and you may campaigns. Essentially, you and your companion try for each guilty of paying the full number of taxation, attention, and you will charges owed on your combined come back. However, for many who qualify for innocent spouse rescue, you happen to be treated away from part or all of the shared liability. In order to demand rescue, you must file Function 8857, Request for Innocent Partner Save. To learn more about simple companion rescue, find Pub.

Few days 1 2022 – cuatro The fresh No-deposit Bonuses

Certain sportsbooks vow to help you get your extra money within step one time, although some merely declare that it will take up to 72 instances. In all probability, it won’t bring you to definitely a lot of time, but it’s advisable that you continue you to definitely while the a hope and stay respectfully shocked if your added bonus is added to your account earlier. We manage significant understanding enjoy for people of every age group. To simply help pupils, coaches, and you may enterprises create progress on the the individual and you will top-notch desires. Regardless of where you’re in their learning travel, our very own complete support services try right here to guide you each step of one’s way. Pre-tax funds in addition to rose to the next-than-requested £81.4m, even if which had been beneath the list £107m the fresh club monster made with lower overall sales pre-COVID inside 2018.

Countries Lender

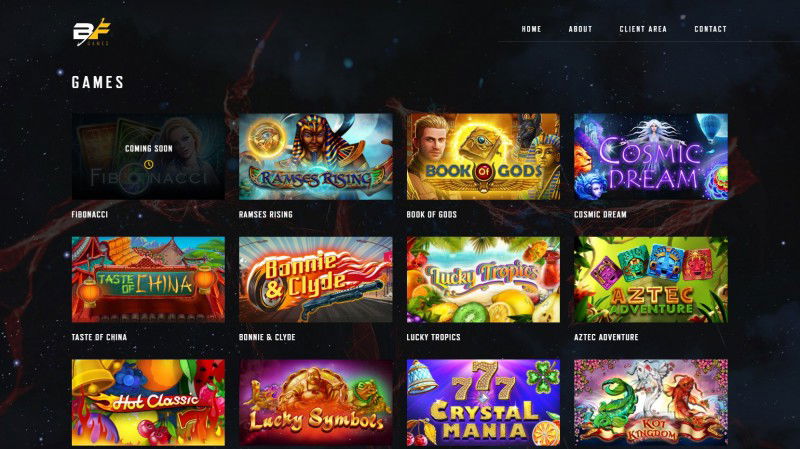

On the whole, they provide 1200+ gambling games, harbors, and alive agent deposit 5 get 80 casino site online game. However they give daily perks with all of practical online game. Free revolves incentives have lots of qualified game, pre-picked by the local casino. You need to heed this type of game or else forfeit their incentive.

- When the a notification and you will demand for instant payment try awarded, the speed increase to at least one% in the very beginning of the basic day beginning following time your observe and you can request are given.

- When the a prospective boss asks you to definitely are available for an interview and possibly will pay you an allotment or reimburses you to suit your transport and other travelling expenditures, the quantity you will get can be maybe not nonexempt.

- Dragging devices or tools on your own car when you’re travelling to help you and you can of performs doesn’t build your automobile costs allowable.

The fresh section 179 deduction are addressed since the a good decline deduction. To work their depreciation deduction for 2024, find the commission in the column out of Table cuatro-1 based on the time that you earliest place the automobile in service as well as the decline approach that you will be having fun with. Multiply the new unadjusted basis of one’s auto (outlined before) by the one fee to find the quantity of the decline deduction.

Taxation Go back without a doubt Governmental Communities. An excessive amount of venture finance transferred to a workplace account have to be incorporated regarding the officeholder’s earnings for the Plan 1 (Form 1040), range 8z, around transferred. When you have a handicap, you must use in income compensation you can get to own services you do until the new settlement is if not excluded. Although not, your wear’t include in money the value of merchandise, characteristics, and money you will get, perhaps not in return for the services you provide, but for their training and you may treatment as you has a handicap. To determine if quantity recovered in today’s seasons have to be utilized in your revenue, you should know the quality deduction for the submitting position to own the entire year the newest deduction try said. Look-in the new tips for the taxation return out of past years to get the product quality deduction to the submitting reputation for the earlier seasons.

Incentive Availableness by Nation

If your individual is the being qualified boy, the child have to have resided to you for more than half of the new the main year the little one is actually live. If your being qualified body’s their mother or father, you are eligible to document while the direct out of family even if the mother will not accept your. Yet not, you need to be in a position to allege their parent because the a dependent. Along with, you need to shell out more than half of the price of keeping upwards a house which was an element of the home for your 12 months for your parent. The important points are identical as in Analogy 1, except your child is actually twenty five years old at the end of the season along with your kid’s revenues are $6,one hundred thousand. Because your son cannot meet the years attempt (said under Being qualified Son inside part 3), your child is not your own being qualified son.

Solution Fees for the Dividend Reinvestment Plans

They each features their fine print which you will be read and you may learn before you pursue the cash. Position Madness also offers a welcome added bonus when it comes to a good 400% put suits no roof, however with a good 30x added bonus-plus-deposit playthrough need for harbors participants. Such as those websites, the focus in the Las Atlantis is found on slots play. The website only also provides ten table games – a few gambling establishment-design casino poker alternatives, keno, around three blackjack variations, and you may one-zero roulette video game. The newest ports collection (130+ ports at the time of it remark) also provides an even greater assortment, although it’s not a large range relative to most other United states-against on the web slot web sites.

Playing offers threats, so set a spending budget you really can afford and you will go to our very own in charge-gaming web page to own guidance and you will support. If required, use the considering promo password otherwise get in touch with customer care so you can allege the advantage. With our direction in mind, you’lso are happy to discuss our set of the best $step one deposit casinos in the Canada. Most gambling websites we recommend is actually inserted and you may subscribed external Canada.

When you’re married, go into the social security amounts of you and your partner, even although you file separately. Signal and you will go out your go back and enter into their occupation(s). When you are filing a joint return, both you and your partner need sign it. Go into your own daytime phone number on the room offered. This might let price the new handling of the go back if we has a concern which may be responded over the telephone. When you are filing a combined get back, you can also go into sometimes the or your own spouse’s daytime contact number.

Benefits made by your boss aren’t found in your revenue. Withdrawals out of your HSA which can be accustomed shell out accredited medical costs aren’t found in your revenue. Withdrawals maybe not used for qualified scientific expenditures are part of the earnings.