Articles

Special laws and regulations implement if you use your car or truck fifty% or smaller on your work or team. If you don’t use the fundamental mileage price, you are able to subtract their genuine car costs. But not, when you are self-working and use your car on the organization, you could subtract you to definitely part of the focus debts you to represents your business use of the auto. Such, if you are using the car sixty% to possess business, you could subtract 60% of the attention to the Schedule C (Setting 1040).

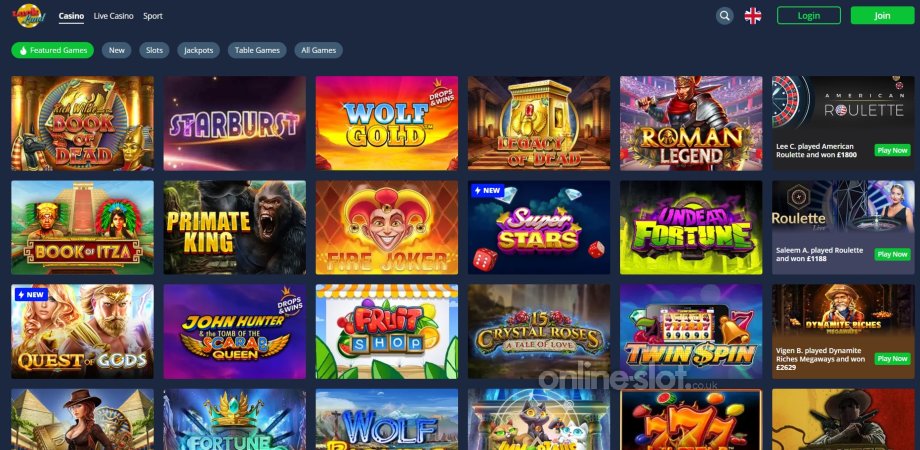

Regulated vs Unregulated Gambling on line Sites in america

I know it that you never heared of one’s casino and this is exactly why I’ll make you more information about the local casino. Needless to say And i am discussing my personal feel at the casino along with the $1 put extra. Personally I like it whenever an internet gambling enterprise provides a slightly various other extra.

Print Your Statement

If the effective, this can secure total settlement packages you to surpass $1 million per year to the MDs. This includes a base salary typically anywhere between $350,000 and you will $600,100, which have incentives usually complimentary otherwise surpassing base salaries. Revealed within the 2006, Competitor Gaming is a great All of us-friendly application vendor one to offers online game to help you at the very least 52 casinos. Inside the more than ten years, Competitor has continued to develop over 2 hundred game inside 11 dialects, so it is probably one of the most popular brands worldwide.

The cash kind of accounting is informed me within the section step 1 under Accounting Tips. However, see Reporting options for cash strategy taxpayers, later. Interest to the U.S. financial obligation awarded because of the any service otherwise instrumentality of one’s Us, for example You.S. Treasury costs, cards, and you can bonds, are nonexempt to possess government tax aim. If you receive noncash merchandise otherwise characteristics in making dumps otherwise to have opening a free account inside a discount organization, you may need to declaration the importance because the interest.

- Are you aware of an on-line casino that has a no deposit promotion one didn’t make my list?

- You, your lady, plus 10-year-dated son all of the stayed in the usa for all away from 2024.

- There are this informative article from the GSA.gov/travel/plan-book/per-diem-cost.

- They could make it easier to ready yourself future tax statements, and you can you desire them if you file a revised come back or are audited.

- If the element of your trip is outside of the You, use the laws revealed later on inside section below Traveling Additional the united states regarding the main excursion.

In order to do this, the gambling advantages on a regular basis provide helpful advice to the a variety from subject areas surrounding gambling enterprises and you may incentives. You will found a cash-property http://www.bet-primeiro.org/en-ca/no-deposit-bonus value extra credit (such as £/$/€10) you will be able to wager on many different online game, and harbors, dining table video game, keno and you can scrape notes. Our specialist articles are made to elevates of pupil in order to expert on your own knowledge of web based casinos, gambling enterprise bonuses, T&Cs, words, online game and you can all things in ranging from.

Paysafecard

Your satisfy foundation (2) since you got copy cost of living. You additionally see foundation (3) as you didn’t dump your own flat within the Boston as your fundamental house, your left their people associations, and you also frequently returned to live in the flat. Generally, your own income tax residence is your own typical place of business otherwise post away from obligation, no matter where you continue all your family members home. It gives the complete town or general area in which the organization otherwise job is receive. Your log off their terminal and return to it after a comparable time.

You bought an alternative vehicle in the April 2024 to own $twenty-four,five hundred and you can used it sixty% to possess business. Centered on your business incorporate, the complete price of your car or truck you to definitely qualifies to your area 179 deduction is $14,700 ($24,five hundred rates × 60% (0.60) team have fun with). However, come across Limit to your complete point 179, special decline allotment, and you will depreciation deduction, talked about afterwards. You could decide to recover all of the otherwise the main prices away from an automobile that’s being qualified part 179 property, to a threshold, by deducting they in the year you add the house in the services.

You happen to be capable favor head away from family submitting condition if you are thought solitary since you real time besides your own spouse and you may see particular tests (said under Lead from House, later). This may apply to you even although you commonly separated otherwise legally separated. For individuals who meet the requirements in order to document because the lead of family, as opposed to since the hitched processing on their own, your own tax could be straight down, you are able to allege the fresh EIC and you will particular other benefits, plus fundamental deduction will be large. Your face out of household submitting reputation allows you to choose the fundamental deduction whether or not your spouse decides to itemize write-offs. For those who get a courtroom decree of annulment, and that holds one to no appropriate matrimony previously stayed, you’re felt single even although you submitted shared efficiency to have prior to ages.

A QCD is generally a great nontaxable shipping produced myself by the trustee of your own IRA in order to an organization entitled to found income tax deductible contributions. For more information, and tips figure your required minimum delivery every year and you may tips figure their required distribution while you are a beneficiary out of a good decedent’s IRA, discover When Must you Withdraw Property? The brand new ten% extra taxation for the withdrawals made before you are free to years 59½ does not connect with these types of income tax-totally free withdrawals of one’s benefits. However, the newest delivery interesting and other income must be advertised for the Setting 5329 and you will, unless of course the newest shipment qualifies to own an exemption to your many years 59½ signal, it might be susceptible to so it tax.