Spot Trading on PrimeXBT: A Comprehensive Guide

Spot trading has become increasingly popular among traders looking to capitalize on market movements. With the emergence of various trading platforms,

PrimeXBT stands out as a versatile and user-friendly option. In this article, we will explore the essentials of spot trading on PrimeXBT, providing a detailed

overview of how to get started, what to keep in mind, and strategies to enhance your trading performance. For an in-depth overview, visit

Spot Trading on PrimeXBT https://primexbt-trades.com/handel-spotowy/, which offers additional insights into the nuances of spot trading.

What is Spot Trading?

Spot trading refers to the purchase or sale of financial instruments, such as cryptocurrencies, for immediate delivery and settlement. In contrast to

derivatives trading, where contracts are traded based on the future price of an asset, spot trading involves the actual asset itself. In this way,

spot trading allows for greater transparency, as traders directly own their assets without the complications of leverage or expiration dates.

Understanding PrimeXBT

PrimeXBT is a leading trading platform that offers a wide array of assets, including cryptocurrencies, commodities, indices, and forex. With a sleek

interface and a multitude of trading features, it caters to both novice and experienced traders alike. The platform also boasts competitive fees, a robust

security framework, and various trading tools, making it a preferred choice for spot trading.

Getting Started with Spot Trading on PrimeXBT

To begin your journey with spot trading on PrimeXBT, follow these steps:

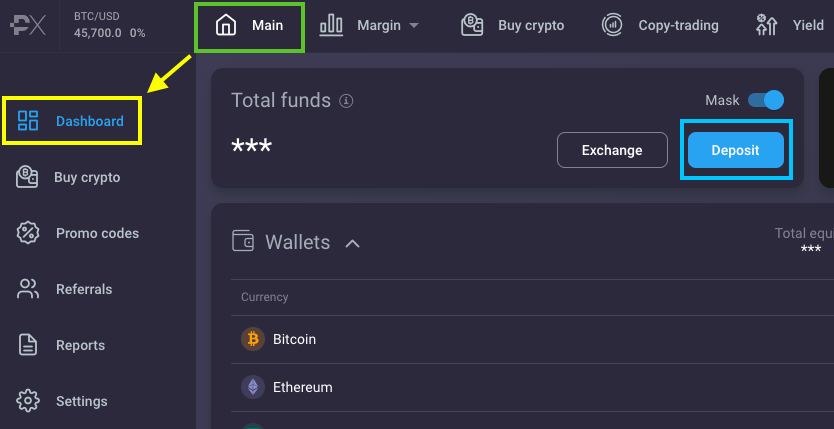

- Sign Up: Create an account on PrimeXBT by providing your email and creating a secure password. Ensure you verify your email to complete the registration process.

- Deposit Funds: After logging in, deposit funds into your account. PrimeXBT supports several cryptocurrencies for deposits, including Bitcoin, Ethereum, and more.

- Navigating the Platform: Familiarize yourself with the user interface. Explore the dashboard, charts, and trading tools available. PrimeXBT offers several tutorials to help users acclimate.

- Choose Your Trading Pair: Select a cryptocurrency pair you wish to trade. PrimeXBT offers numerous pairs, allowing traders to take advantage of market opportunities.

- Place Your Order: PrimeXBT provides various order types, including market and limit orders. Choose the one that aligns with your trading strategy.

Strategies for Successful Spot Trading

Success in spot trading requires a well-thought-out strategy. Here are some effective strategies to consider:

1. Technical Analysis

Technical analysis involves using historical price data and trading volume to predict future price movements. Utilize PrimeXBT’s extensive charting tools to

identify trends, support and resistance levels, and key indicators such as relative strength index (RSI) and moving averages. This analytical approach can enhance

trading decisions.

2. Fundamental Analysis

Understanding the underlying factors that influence an asset’s price is crucial for successful trading. Stay informed about crypto news, market trends, and developments

within the blockchain space. This knowledge will give you insight into potential price movements and help you make informed decisions.

3. Risk Management

Effective risk management is essential. Determine the amount of capital you are willing to risk per trade and use stop-loss orders to safeguard your investment.

Diversifying your portfolio and not putting all your funds into a single asset can also help mitigate risks.

4. Keep Emotions in Check

Trading can evoke strong emotions, especially during volatile market conditions. Establish a clear trading plan with specific entry and exit points, and stick to it.

Avoid making impulsive decisions based on fear or greed, as these can lead to losses.

Benefits of Spot Trading on PrimeXBT

Spot trading on PrimeXBT offers several benefits that make it an attractive option for traders:

- Instant Execution: Spot trades are executed immediately at the market price, allowing traders to capitalize on swift price movements.

- Full Ownership: When you engage in spot trading, you own the asset outright, providing you with greater control.

- No Expiration: Unlike options and futures contracts, spot trades do not have an expiration date, allowing for long-term holding strategies.

- Diverse Asset Selection: PrimeXBT offers a wide variety of trading pairs, allowing traders to diversify their portfolios easily.

Common Mistakes to Avoid in Spot Trading

As an aspiring trader, it’s important to learn from common pitfalls. Some mistakes to watch out for include:

- Overleveraging: While PrimeXBT offers leverage, using too much can amplify losses. Stay conservative with leverage to protect your capital.

- Neglecting Research: Failing to conduct proper research can lead to uninformed trading decisions. Always analyze and stay updated.

- Following Trends Blindly: Avoid the trap of following what others are doing without understanding the market context. Develop your own strategy.

Conclusion

Spot trading on PrimeXBT presents an exciting opportunity for traders looking to engage in the cryptocurrency market. By understanding the essentials, employing effective strategies, and managing risks, you can optimize your trading experience and potentially enhance your profits. Start your spot trading journey on PrimeXBT today and unlock the potential for financial growth.